Inverness: 01463 419 137Glasgow: 0141 440 7433

Did you know...Annuities

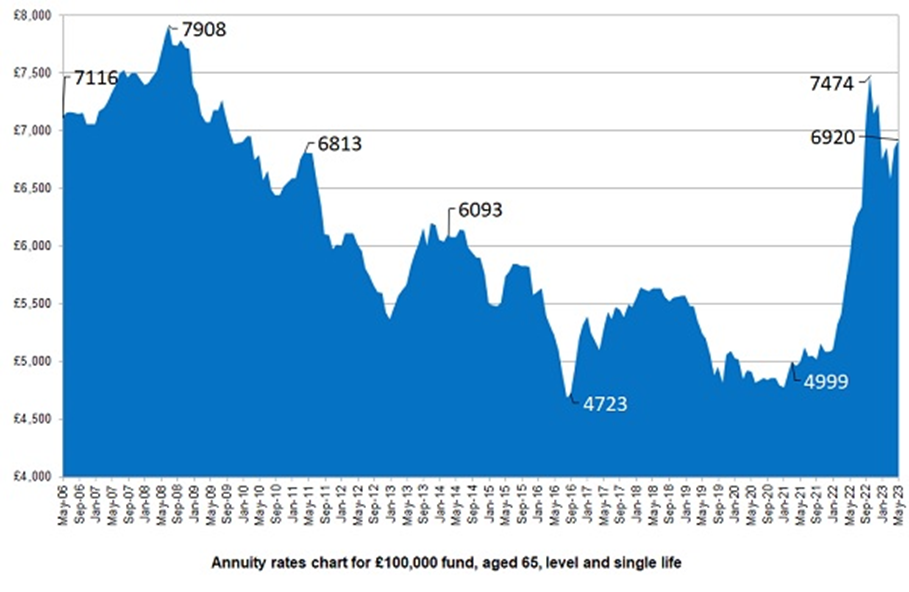

In the current high interest rate environment, annuities have become a more attractive option for some for taking retirement income. The Annuity rates offered by providers are at the highest level we have seen in the last 14 years. Is now the time for you to consider this for your pension options? Below I will discuss the questions most frequently asked by our clients.

Article by Stephanie Johnstone DipFA Cemap Diploma LIBF

Independant Financial Adviser

In the current high interest rate environment, annuities have become a more attractive option for some for taking retirement income. The Annuity rates offered by providers are at the highest level we have seen in the last 14 years. Is now the time for you to consider this for your pension options? Below I will discuss the questions most frequently asked by our clients.

What is an annuity?

An annuity allows an individual with a defined contribution pension to purchase a guaranteed annual pension income. You can still take your 25% Tax Free Cash allowance and use the remainder of the pot to purchase the annuity. In times of stock market volatility, an annuity will de-risk the value of your pension pot because it is no longer exposed to the stock market. It is also possible to purchase an annuity with part of your pension fund, leaving the rest invested to make income decisions at a future date with this part of the fund.

The annuity can be written in the following ways:

Level annuities

A level annuity will pay you the same income each year. They have a higher starting income than an escalating annuity, but they can leave you vulnerable to inflation, which might make your annuity income worth less over time. Even low levels of inflation can significantly reduce your standard of living.

Escalating annuities

An escalating annuity will rise each year at a fixed rate. It may start lower than a level annuity, but the amount it pays you will increase at a fixed rate each year (for example, by 3%) hopefully offsetting some of the rises we are seeing with inflation.

Inflation-linked annuities

An inflation-linked annuity will rise each year in line with the retail price index. This protects your annuity against inflation, but it will start at a much lower rate. You'll need to consider your particular circumstances, such as your health, whether you want to receive an annuity income over a short or long term, and whether you want to leave an income to a spouse or partner after your death.

Impaired or enhanced annuities

These pay out a higher income if your health or lifestyle may shorten your lifespan – for example, if you have an existing health condition or you smoke or are overweight. It's important to make sure that any provider you speak to asks you about your health so they can properly consider whether you're eligible for an impaired or enhanced annuity, as the income rates may be considerably better than other types of annuities.

Lifetime annuities

These will pay you an income for the rest of your life, unlike a short-term or fixed-term annuity.

Joint life annuities

These will pay an income to your spouse or partner after your death, this can be arranged at a lower rate to accommodate the individual’s needs.

Short-term or fixed-term annuities

You can use part of your pension pot to buy an annuity that provides a short-term income. The rest of your pot is left invested, and you can still choose to buy a lifetime annuity when your short-term one expires. You might choose a short-term annuity if you don’t want to commit your pension fund to a life annuity as you believe rates might get better in the future. These are particularly useful if there is a specific need for a higher income for a shorter period of time or if you want to use a pension pot to allow you to retire early.

Guaranteed Maturity Value

In some instances, having a pot of money left at the end of a fixed term annuity may be of benefit to a client. Annuities with a guaranteed maturity value can facilitate this.

Why are annuity rates rising?

UK annuity rates are going up because they’re closely linked to interest rates and government bond yields. Annuities are based on future liabilities for insurance companies and the current economic situation is supportive for providing the guarantees on annuities.

|

Lifetime Annuity income - last 17 years |

|

Based on figures for May 2023 |

|

(Source: sharingpensions.co.uk) |

In the chart above, we can see that Annuity pension income reached an all time low of £4,696 pa in August 2016. However, if you look at the May 2023 data the potential income for a 65 year old, with the same £100,000 pension pot on a single life, level and no guaranteed period is £6,920 per annum an increase of 47%. (Source: sharingpensions.co.uk)

What impacts annuity rates available?

A lifetime annuity will often pay out less annually than a fixed term annuity due to it being open ended ie based on how long you live. However, the longer you live, then you could potentially receive more income than the initial value of the pension pot used to buy the annuity. Other factors, like your age, health history and the size of your pension pot, will affect the annuity rate you’re offered.

Where can I buy an annuity?

Often your own pension provider can offer you an annuity, however searching the open market to find out what alternative annuity providers can offer could be advantageous. It is always best to get independent financial advice to review your options.

What happens if I die?

It is important to consider what should happen to your pot should you die. You may want this to pass on to your beneficiaries. If you opt for a lifetime annuity with no guarantees then nothing is payable on your death. However, if you select an option with annuity death benefits then you can ensure your beneficiaries do not miss out. Annuity death benefits can include guaranteed periods, joint life/nominee annuities and value protection. These additional benefits must be selected at point of application.

Guarantee Periods:

A guaranteed period is a minimum period of time for which an annuity will be paid, irrespective of how long the individual lives.

Joint life/nominee annuities:

From 6 April 2015 legislation allows new joint life annuities to be passed on to any beneficiary. On the death of an annuitant, a joint life annuity will continue to be paid to the survivor for the rest of the survivor’s lifetime – and the survivor doesn't need to be a dependant. However, the annuity provider may restrict this, say to a named beneficiary. If the member chooses a joint life annuity with, say, a grandchild, the annuity payments are likely to be paid for much longer than if the joint annuitant is in the same age group as the annuitant. So the initial starting annuity would be much lower. A joint annuity can continue to be paid at any rate up to 100% of the annuity payable to the annuitant. The level that would be paid to the survivor will be set out in the annuity policy terms and, again, is reflected in the cost of buying the annuity.

Nominee Annuity:

The terms of the nominee annuity are agreed at the point the member’s annuity was purchased. This is where the member can nominate anyone (not limited to a dependant) to receive an ongoing annuity on the death of the member (although this would be subject to agreement by the provider). The difference from joint annuities is that the nominee's annuity isn’t a continuation of the member's annuity, but a stand-alone annuity with its own terms and conditions, payable on the death of the member.

Value Protection:

Value protection allows a lump sum (after tax if applicable) to be paid on the death of the annuitant. Value protection may not be provided in combination with any other death benefit. The maximum amount (before tax) that can be paid under value protection is the Annuity purchase price minus the total amount of the annuity payments to date of death (ignoring any tax deducted on the annuity payments).

Taxation on Death:

If you die before your 75th birthday

Your beneficiary(ies) will receive a lump sum equal to your initial investment, minus any payments made up to the date of your death, tax free.

If you die on or after your 75th birthday

Your beneficiary(ies) will receive a lump sum equal to your initial investment, minus any payments made up to the date of your death and are taxed at the marginal rate of the beneficiary at the time of death.

In both cases, your beneficiary(s) may have the option to either take the lump sum or to transfer it to a beneficiary(s) pension arrangement.

Payments to beneficiaries under a guarantee period may be subject to Inheritance Tax.

Risks:

- Longevity risk – if you select a fixed term annuity and outlive the annuity term, you will have to fund the income required from alternative sources.

- Inflation risk – if you chose a level income, or an income that increases each year by less than inflation, your income may not keep up with rising prices

- You will not be able to change the plan after it has started

- If you choose to take your Guaranteed Maturity Value as a cash lump sum, this will be treated as taxable income and may result in you paying a higher rate of income tax.

- Income payable may have an impact on any means tested state benefits you receive

- Stock market risk – if the stock market rises after you purchase an annuity, you will not benefit from any capital growth on your pot.

- Income from an annuity is taxable income.

The risks relevant to an individual’s situation would be presented alongside a recommendation, the above list provides some examples.

If you feel like you could benefit from an annuity, please contact the office and I would be happy to discuss all your options with you, before making a recommendation for the most suitable solution based on your circumstances and needs.

Stephanie Johnstone DipFA Diploma CeMAP MLIBF

Independent Financial Adviser.

News Home